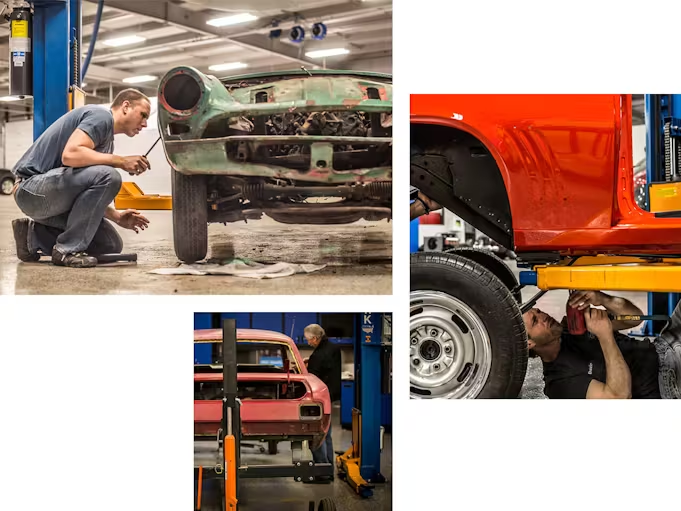

Your abilities as a restorer or builder set you apart from the standard shop. With success comes risk, unique to you and your business. And that’s where Hagerty can help – by customizing insurance coverage to meet the highly specialized needs of your business.

Coverage for car restoration shops

You can protect your cars for what they’re actually worth

A restoration policy with Hagerty pays out true market value at time of loss, and we rely on our vehicle and valuation expertise to determine accurate, up-to-date values. A policy with us also provides reassurance to your clients should you be liable for any damages.

You won’t need to call every time a car comes or goes

When inventory is always changing, it’s hard to keep track of what you’ve added to an insurance policy. A one-limit blanket policy with Hagerty means you won’t need to call in and cover each car individually.

There’s no per-car value limit

If you end up with an especially valuable car, you won’t need to worry whether it’s protected for its true value. With a blanket policy, there’s no vehicle-cap per limit.

Your program also includes what you need most

- Direct primary on garage keepers

- Actual loss sustained for business interruption

- $250k in show and exhibition coverage included - higher limits available

- Employee tool coverage

- Transit coverage

Program coverages available

- General liability

- Building and business personal property

- Garage liability

- Workers comp

- Umbrella

- Directors and officers

- Cyber crime

- Pollutant clean up

1 business day.

more information?

* Less any deductible and/or salvage value, if retained by you. Guaranteed Value includes all taxes and fees unless prohibited by state law.

Policies underwritten by Markel Insurance Company, Markel American Insurance Company or Travelers. Hagerty determines final risk acceptance. Some coverage not available in all states. This is a general description of coverage. All coverage is subject to policy provisions, exclusions and endorsements.