Rising rates slow new car sales, Bugatti automobilia goldmine for sale, IMSA’s end of an era

Analysts warn rising interest rates may squash new car sales

Intake: Tight supply chains and low inventory may be hampering new car sales currently, but there’s a storm on the horizon that may compound the headache that automakers are feeling around the world: interest rates. “It seems likely that much of the pent-up demand from limited supply is quickly disappearing as high interest rates eat away at vehicle buyers’ willingness and ability to purchase,” Charlie Chesbrough, a senior economist with research firm Cox Automotive, told The Wall Street Journal in an interview this week. Cox Automotive lowered its 2022 U.S. sales forecast to 13.7 million new vehicles—which would be a nine percent drop from the previous year. That’s a stark drop from the five years leading up to 2020, where the industry was moving more than 17 million vehicles annually. Profitability remains high thanks to record sales transactions for new vehicles, however; the average price paid for a new car in the U.S. in Q3 hit $45,971, up 10 percent from the previous year and the highest figure on record, according to figures provided to the WSJ by research firm J.D. Power. But interest rates are rising along with those prices—September’s average rate was 5.7%, versus just four percent the year prior.

Exhaust: With the Fed promising additional hikes in the coming months to combat inflation, it’s looking like things will only get worse in the short term. Despite the prevailing market conditions, automakers remain confident that pent-up demand can overcome what’s ahead. “There is still really strong consumer demand, and huge replacement demand,” said Duncan Aldred, head of the Buick and GMC Brands in an interview last month in Detroit. “I think that will probably overcome a lot of the economic headwinds.” Will buyers share those same optimistic sentiments? – Nathan Petroelje

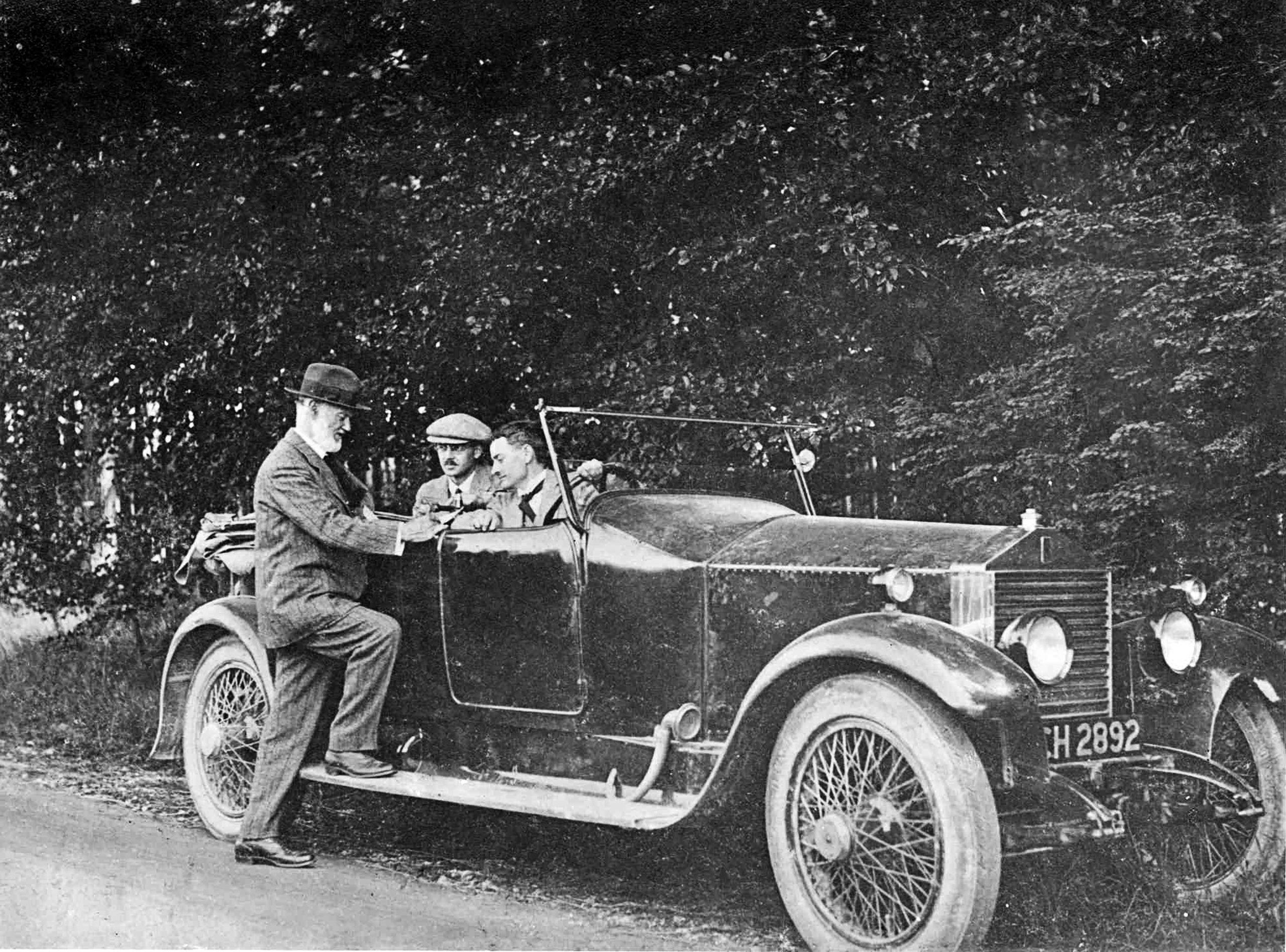

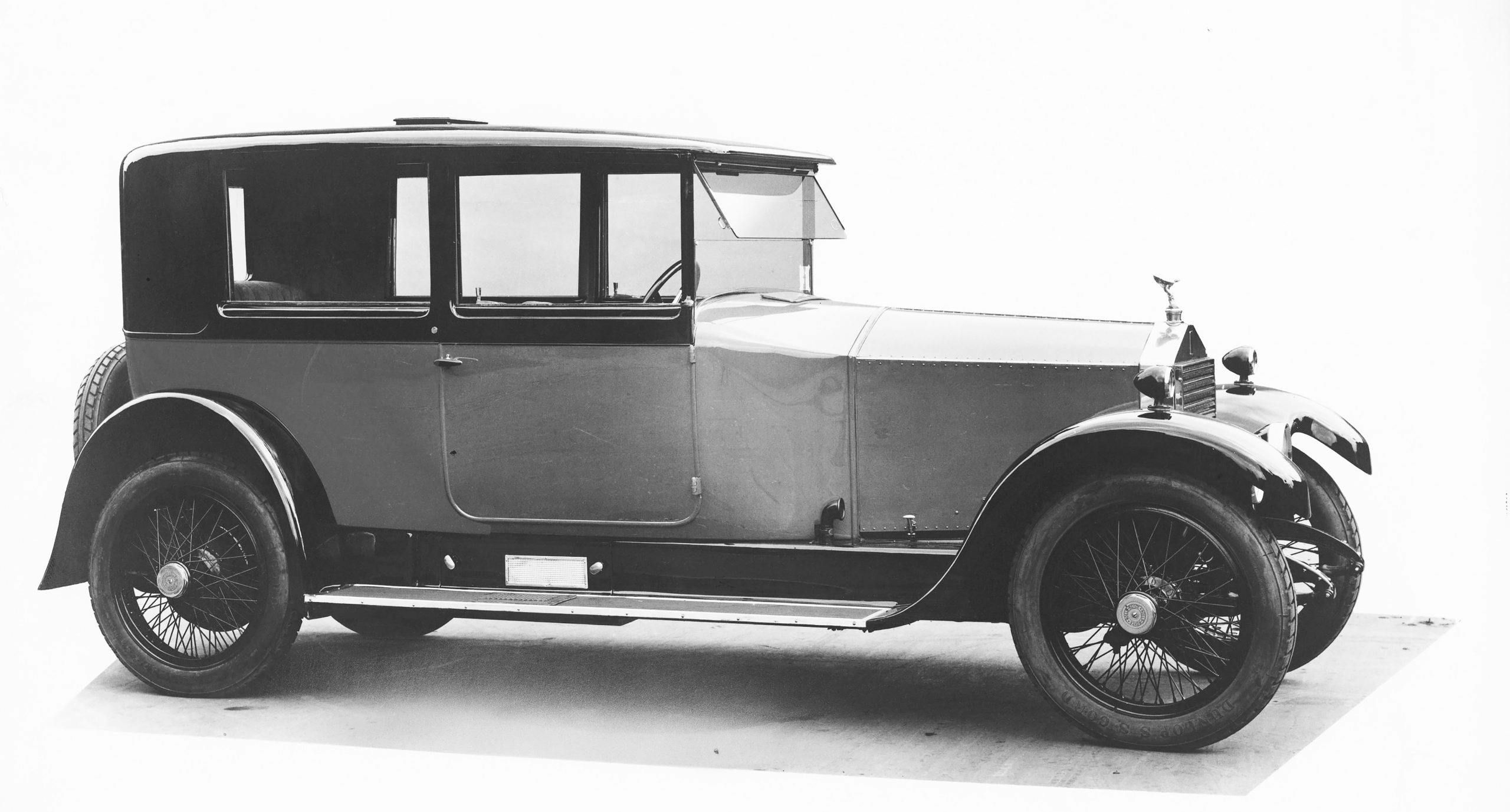

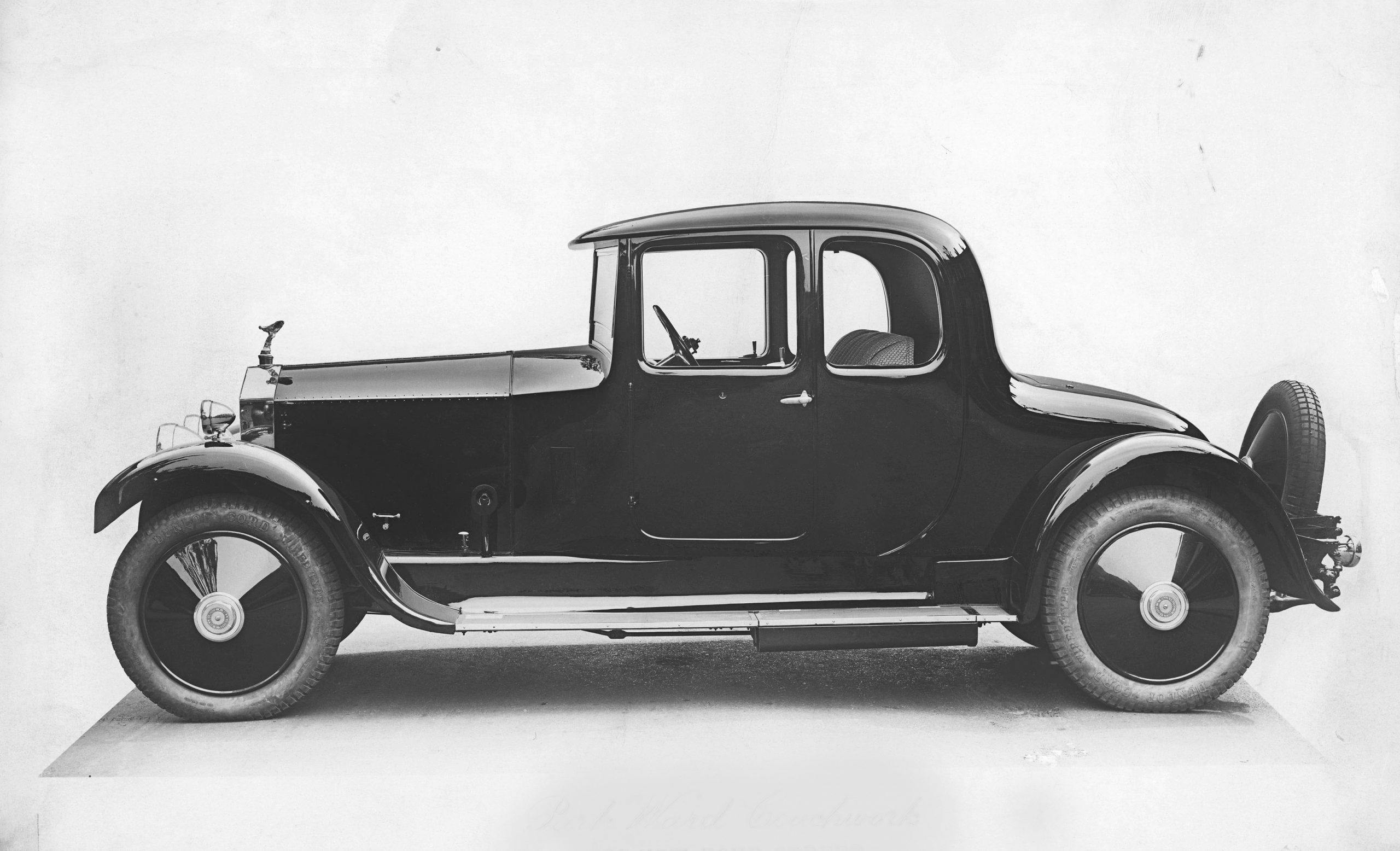

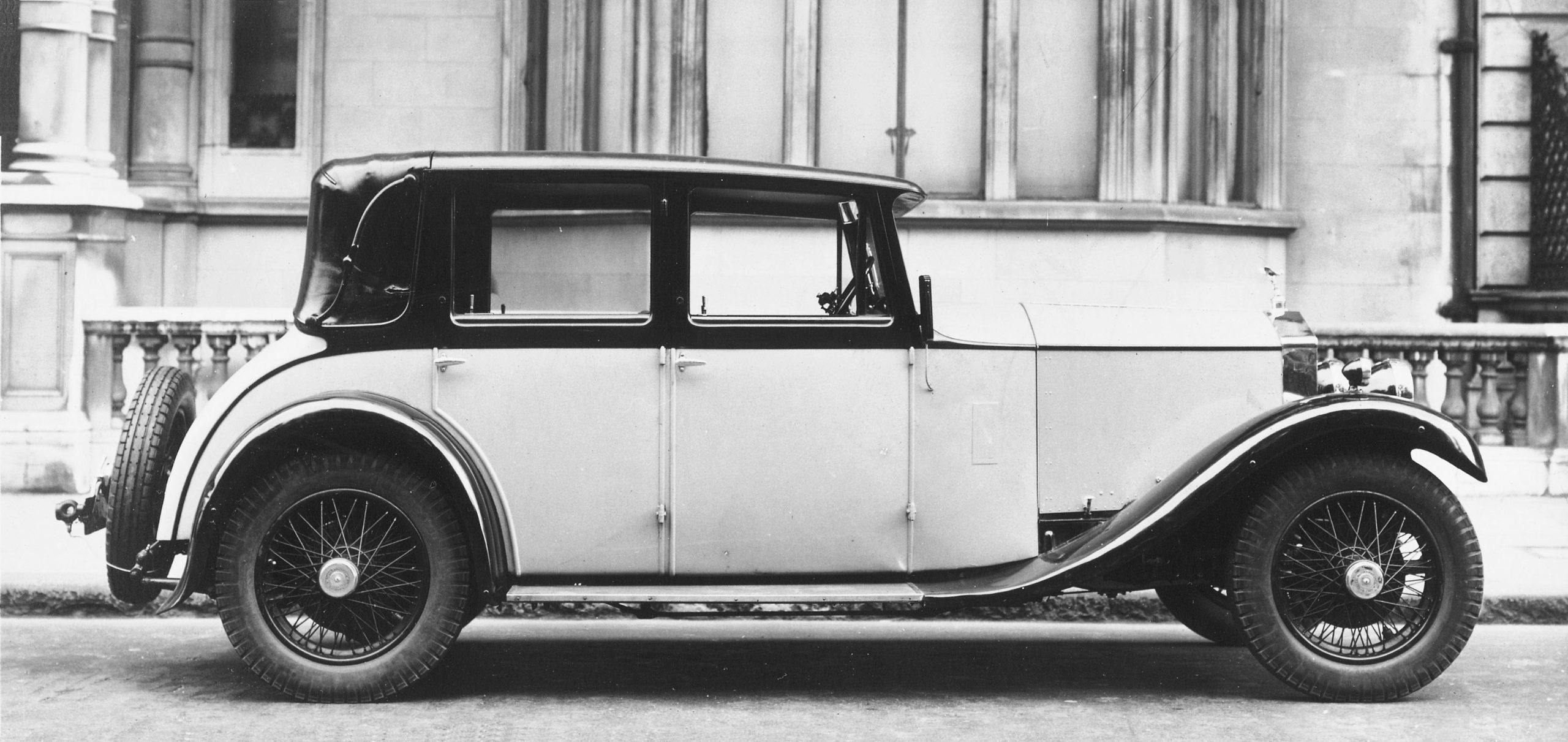

Centenary celebrations for the first “owner-driver” Rolls-Royce

Intake: October 6 marks 100 years since Rolls-Royce launched its 20 H.P. model. The Twenty was a car for a new post-war world that needed neither the regular weekly maintenance of the Silver Ghost, nor a chauffeur to service and drive it. Instead, the Twenty was a car for owner-drivers, with a 3.1-liter six-cylinder engine less than half the size of the Silver Ghost’s 7.5-liter unit, and a chassis that was at least one-third lighter. Rolls-Royce advertised the car as providing “everything a motorist can want … motoring with a high degree of refinement and its simplicity of construction will delight the driver.” It was a roaring success, with 2940 units being built by the time production ceased in 1929, while the Twenty’s engine, with its detachable cylinder head and overhead valves, would continue to be developed over the next 30 years.

Exhaust: There was a slight problem with Henry Royce’s plan. Like all Rolls-Royce cars of the time, it was sold as a rolling chassis which customers would hand over to coachbuilders for bodywork. Many of those customers and coachbuilders failed to move with the times and an awful lot of Twenties ended up with overweight traditional bodies that went against Royce’s principles and blighted the car’s performance. The only way to solve this was to introduce a larger capacity 20/25 H.P. model, but even that wasn’t quite enough and by 1935 the base Rolls-Royce motor had grown to 4.25 liters. — Nik Berg

Ettore Bugatti’s boat, hat and Baby are up for auction

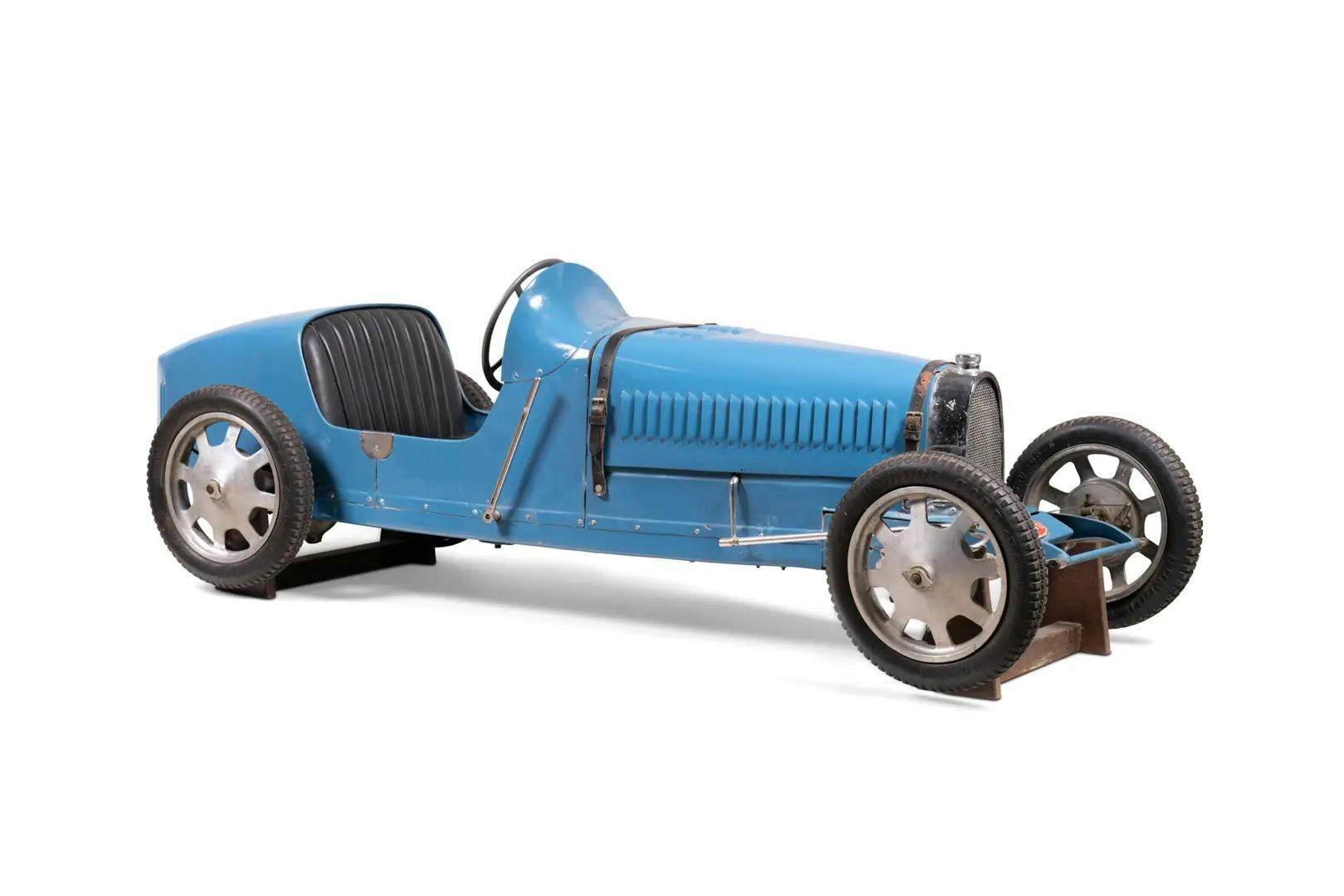

Intake: One of Bugatti’s biggest fans is putting his collection of automobilia up for sale at a Gooding & Company auction in November. Among the lots are the trophies won by William Grover-Williams at the 1928 French Grand Prix and by Jean-Pierre Wimille and Robert Benoist at the 1937 24 Hours of Le Mans, plus a photo album documenting Elizabeth Junek’s remarkable fifth place finish at the 1928 Targa Florio. There are handwritten pages from Ettore Bugatti’s memoirs, his baptism document, together with various contracts, design drawings, and notes. While these would be wonderful to display, there are three items that could be put to more practical use. There’s a 1946 Type 75 You-You Boat, designed by Bugatti and built at the Maisons-Laffitte boatyard, that you (and you) could bob about in, a 1933 Type 52 Bebe for your kids to drive, and Bugatti’s E Motsch Fils top hat to tip at the next concours dinner.

Exhaust: For Buggatiste this is an incredible opportunity to obtain items closely connected to the great man himself, but should you miss out on the auction don’t worry as you can still buy a Bugatti Baby II brand new from The Little Car Company. – NB

Nearly 120 plug-in vehicles will hit the market by 2026

Intake: A comprehensive study in Automotive News lists almost 120 new plug-in vehicles that are expected to arrive by 2026. That’s in addition to the battery-electric vehicles that have already gone on the market this year. Twenty manufacturers, Automotive News says, are expected to markets EVs for the first time in the next five years. They are Subaru (2022), Lexus, Maserati, Ram, Rolls Royce (2023), Acura, Alfa Romeo, Buick, Dodge, Honda, Jeep, Land Rover (2024), Aston Martin, Bentley, Chrysler, Infiniti, Lincoln (2025), and in 2026, Ferrari, Lamborghini and Mitsubishi.

Exhaust: Like it or not, almost every automaker who does business in the U.S. will have an electrified offering on the market by 2026. It’s still expected to make up a small-to-moderate impact on overall sales, but the trend that 120 plug-ins represents can’t be denied. Think of it like this: The next president will only be halfway through his or her term when all these electric vehicles will be on sale. — Steven Cole Smith

Petit Le Mans race the end of an era for IMSA

Intake: The season-ending 25th annual Petit Le Mans, the 10-hour endurance race at Michelin Raceway Road Atlanta, was the end of an era for IMSA’s top class. After six years of leading the grid, the Daytona Prototype international (DPi) cars ran their last race before being replaced next year by the all-new GTP cars that will debut in January at the Rolex 24 at Daytona. Coming out on top was the number 60 Meyer-Shank Racing Acura, with drivers Helio Castroneves, Oliver Jarvis and Tom Blomqvist. Actually, a couple of incidents made it a relatively easy race for the Acura: With 51 minutes left, the two Chip Ganassi Racing Cadillac DPis, which were the class of the field, were battling for the lead when they collided in turn 1, leaving both cars in the gravel, which likely made for a tense flight home in the Ganassi airplane. That left the Meyer-Shank Acura fighting the number 10 Wayne Taylor Racing Acura. With 14 minutes left, the Taylor Racing Acura was going for the lead when it brushed against a lapped GT car, damaging the rear suspension. Thus ended the DPi era, with the number 60 Acura winning both the race and the season championship.

Exhaust: The DPi cars served well as IMSA’s flagship class, but it’s time for the new GTP cars to take the stage. Cadillac and Acura will be back, joined by Porsche and BMW, and in 2024, Lamborghini. Some of the manufacturers, including Porsche, are selling customer cars to privateers which should help fatten up the grid for 2023. — SCS

Interest rates will definitely hold things back like in houses. The reality is that we have been buying more car and house thanks to the low rates. But with higher rates and ballooning payments something has to give.

Good, the inventory of new cars will catch up again. Prices will stabilize.

The fundamental idea of rising interest rates is that it will decrease demand for pretty much anything sold on a loan basis. That’s the main tool for fighting inflation. As a general rule, it means that manufacturers will decrease prices, which is how inflation is fought.