The Hagerty Market Rating just hit a new high, which is even wilder than it sounds

The word “unprecedented” gets thrown around a lot these days. How else are we supposed to describe what is happening in the world?

After a year-long buying frenzy and record breaking auctions at Kissimmee and Scottsdale last month, the classic car market is receiving the same level of bewilderment. But, here at Hagerty, we’ve been keeping a close eye on the classic car market for decades—even going as far as creating our own Hagerty Market Rating. This gives us the unique ability to look at the “unprecedented” heat of the classic car market and see some, um, precedent.

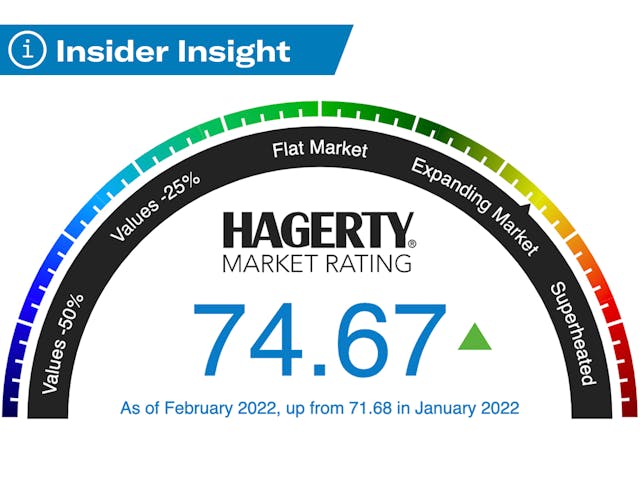

The Hagerty Market Rating conveys the performance of the classic car market as a 0-to-100 number. The higher the number, the hotter the market. The Rating is calculated through a comprehensive algorithm of fifteen weighted measures including the Hagerty Price Guide, auction transactions, insurance data, opinion from industry experts, and the world’s largest database of private sale transactions. A detailed explanation can be found here.

Since its inception in 2007, the Hagerty Market Rating has never been as high as it is now. What’s more surprising is the exponential growth since the pandemic. After hitting a 5-year low in September 2020, the market rating jumped nearly 16 points in just 17 months.

That may not sound like news—we've all seen the prices at auction of late. Yet it's notable because the Market Rating is designed to take those headline sales with a grain of salt. Those of you who took statistics in high school might remember the bell curve distribution. The (very) boiled down refresher is that certain numbers in a dataset are more probable than others. In baseball, a hitter at the bottom of the lineup might have a .100 batting average, and a hot lead-off man might be hitting .350; most players, however, are going to fall around .265. For the collector car market, we assume the probable performance, as represented by the Market Rating, will be "flat." So, the higher the rating goes, the more market activity it takes to keep moving the number up. The inverse is also true—it takes more than a few poor showings at auction to crank the needle to 0.

The only other time we've seen growth like this was after the Rating hit its all-time low in December 2009 (47.4). When it then grew 14.4 points in 19 months, it was assisted by the Market Rating's desire for balance. The growth in the early 2010s was mostly a market correction after the Great Recession and resulting drop in the classic car market. The Rating then went on to grow slowly for the next several years to its previous high point in May 2015 (71.9).

Similar to the peak in 2015, nearly all 15 components are contributing to the current strength of the Market Rating— four of which are currently at an all-time high.

Those components include "correlated instruments," which measures the health of the economy through a combined look at housing prices, retail sales, gold and the S&P 500; auction and private sales activity, which has broken previous records as the volume and average prices have skyrocketed; and the Hagerty Price Guide, where median #3 condition values have never been higher.

These are the same components that led to the peak in 2015, but what's different is the velocity. In the previous peak, it took more than three years for the rating to move from 60 to 70. Now, it did that in a third of the time. Last month, the Market Rating jumped nearly 3 points, the second largest single month jump ever. What makes the most recent exponential growth even more impressive is that it occurred when the Rating was already above 60—the "Expanding Market" range—where the any further Market Rating growth needs even more increased market activity.

Those of you who follow along regularly might be wondering how the Market Rating can be so hot when the 300SL Index is trending down. The answer is that they're probably both right but look at different things. Stocks can be up, but average wages can be down. What matters, at the end of the day, is your wallet and, in the case of collector cars, your garage.