Is depreciation back? Yes, suggest 911s and Corvettes

As we mark the halfway point of 2023, the Hagerty Market Rating, which has dropped for 10 out of the past 12 months, reminds us what a difference a year makes. Even though we’re still seeing records at auctions and premiums for the latest supercars, trends show a leveling off or even a receding pattern for some of the hottest cars in the market. One segment in particular highlights this well: “instant” collector cars.

These models—like the Chevrolet C7 Corvette ZR1 and C8 Z06, and Porsche’s GT line, both of which have tremendous pent-up demand—have come on strong in the last decade. Porsche and Ferrari figured out the recipe early on, and now even Chevy and Ford have successfully cultivated enthusiasm for their halo cars to bolster demand and increase exclusivity. Widespread dealer markups as well as significant premiums on the secondary market have sprung up as a result, but that tide is turning.

While visible in market pricing, the phenomenon is also confirmed by Hagerty’s data, and we’re able to track it over time. Hagerty insures a lot of vehicles built well over 25 years ago, but we also cover a wealth of modern enthusiast vehicles that aren’t used every day. Our guaranteed value policy means we work with owners to understand the market replacement value for the vehicle. If an owner needs to replace a 2021 Ford Mustang Shelby GT500, we know that they’re selling for more than the number on the window sticker (MSRP). As cars trade hands and new owners add vehicles to their policy, those values show us how much a vehicle has depreciated or appreciated over time.

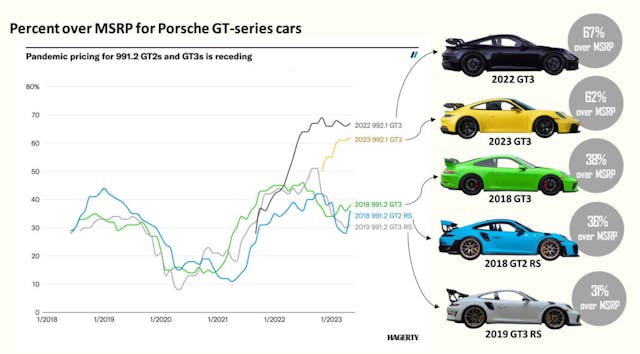

Porsche’s 911 GT2 and GT3 models, particularly the RS variants, have long commanded premiums as new vehicles, and over the last five years they have continued to sell above MSRP even when they hit the secondary market. The older 991-generation cars (model years 2018 and 2019) trended 30 to 40 percent above MSRP in early 2019 but then dipped to the teens in mid-2020. They then rebounded to over 40 percent over sticker during the summer of 2022. The current, 992-generation GT3 saw even higher premiums over the winter of 2022 to 2023. However, the market for all five variants is showing signs of slowing. Values in 2023 for the 991-generation cars even appear to be depreciating.

***

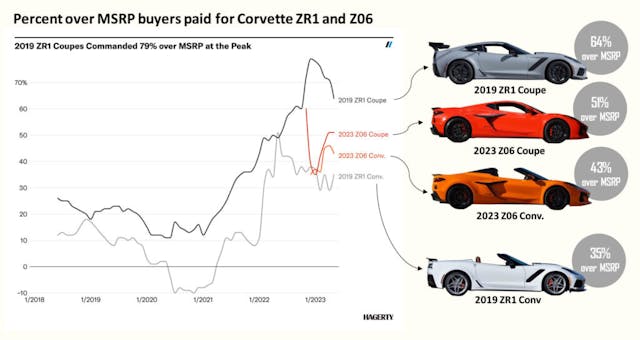

Another vehicle that has shown even greater appreciation since 2020 is the 2019 Chevrolet Corvette ZR1. Available in both coupe and convertible, the highest-performance version of the last front-engine Corvette increased in value by almost 70 percent for the coupe over 30 months starting in mid-2020. The convertible ZR1 lagged slightly but still appreciated by almost 60 percent over the same interval. Similarly, the 2023 Z06 coupe and convertible hit the market at a premium and are still trading well above MSRP. However, like the GT-series Porsche 911s, the value trend for these Corvettes appears to be slowing or even depreciating over the last few months.

***

The 2020 Ford Mustang Shelby GT500 made it to the market in late 2019 and immediately trended up from 20 percent above sticker to more than 50 percent by mid-2021. The 2021 model saw an even higher peak at 61 percent over MSRP in mid-2022. Coincidentally, that was about when the 2022 model reached the market. Over the past twelve months, values for all three have dipped or leveled off.

***

While many other models have traded for a lot more than sticker over the past couple of years, the last vehicle we’ll examine is the Ferrari SF90. With nearly 1000 hp from its hybrid powertrain, it is one of the fastest models in Ferrari’s lineup, but Maranello hasn’t capped production. The 2021 coupe version reached the market in early 2021 and quickly appreciated to 70 percent above MSRP. The 2022 Spider variant appeared in early 2022 but appreciated to “only” 60 percent above the MSRP. The coupe has depreciated since its mid-2022 peak, and the Spider is also starting to show signs of slowing appreciation.

***

In aggregate, flips (which we define for these purposes as a resale from 2018 to present; our data average a 1.8-year hold) where one of the above-mentioned models went to a new owner show a slowing market, too. While the average return on a flip increased in 2021 and 2022, flips completed in 2023 show a lower average return.

What’s causing this downturn, which many enthusiasts will likely see as an opportunity?

For one, higher interest rates and tightening standards for auto loans mean that fewer people are able to stretch their budget to attain one of these cars. Among the modern supercars we insure, we see signs of a decreasing share of them being financed—something we will be covering in greater detail soon. While the pandemic disrupted many of the usual ways of doing things, including within the car market, many of the hottest modern performance cars are starting to depreciate again. Let us know what you think is causing it in the comments.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.

The C7 and 8 were all about supply and demand. There is no real mystery with this situation.

This is not like the others here. Once supplies return to normal normal pricing will apply. This was just a case of people just over paying because they could not wait.

Now the older models are still doing well. The C5 for this year is showing a 20%-30% increase depending on the year and model. Tuners are all over them right now.

so where is a good place to go and find the value of the vett. I have a 2000 C5 very rare NASSAU BLUE, w/38000 mile mint condition to much to list 2nd owner Thanks

Wonder what the market value curves for crusty, early-60s Thunderbirds that may be equal parts rust and sheet metal looks like…

I think this was inevitable, given the dynamics. As noted, many of these acquisitions were based on the attraction of a strong flip market. Drive it for six months and generate a profit mindset. No real attachment or consideration of intrinsic value or long-term ownership benefits. Now compounded by high interest rates and banks’ reluctance to lend. And we are now seeing large corporate landlords walking away from mortgages on shopping centers and office complexes. The knock-on effect will be more bank failures and further tightening. Unless you’re making shedloads of money in crypto, you may be caught out. That said, the high-net-worth players pursuing seven and eight figure Ferraris, Bugattis, et. al., will remain largely unaffected.

I been trying to sell my 1989 ford f150 4×4 shortbed pickup with 300 6 cylinder engine that i consider grade 2 excellent condition for $24,500 and latest hagarty evaluation says my truck is $29,000. I feel im listing it for a good price but noone seems to be interested in it. Been on market 4 months. Square body trucks are getting harder to find in this condition.

*9 is a little new to get what your asking–You’d have to find the Perfect buyer-

So the prices will be just stupid instead of horrific. Great.

The Corvette’s or 911’s I would want are still too expensive. I considered a Shelby GT500 and walked away. The dealers made it impossible to feel food about that car.

You can get a new Corvette for MSRP through McMulkin Chevrolet. However, you will have to wait for your

car order to be filled from their various allotments.

Look in-between the seat and the console. You may find some old french fries there.

In May I took delivery of a new C8 Corvette Convertible. Love the car and all it’s new features. Also had to wait 11 months from the time I sent in a deposit on my car until I got delivery here in Phoenix. Paid cash for my car and I should mention that GM is raising prices again. So say goodbye to 2023 prices soon.

Pretty funny. Let’s step back and get some perspective.

The graphs are of how much folks paid over sticker, yes, over sticker.

If you can pay that much over sticker, you’re gambling and you can afford to lose.

Folks who can afford to do that are by and large the vast minority.

So the $500,000 Ferrari a dude bought for $900,000 is now only worth $870,000….mountains, mole hills and tiny violins.

They are just expensive optional versions of mass produced cars. Why they would have gained in value or held their value from new is the thing that doesn’t make sense. They should depreciate over a couple of decades and then show a reversal as they become rarer and more collectable. Hovever almost all of them were bought by car collectors and are mostly unused, so there will be no increased rarity and value, and no premium for low miles. Their numbers and condition are unnaturally uniform. Frankly that should spell very gradual long term depreciation. The longer they sit unused, the more expensive it will become to gwt them working again.

Back in the 80’s and 90’s in Canada I bought and sold 4 air-cooled 911’s. Each one was sold for $5,000 more than I paid. This, at a time when ALL Porsche’s were a depreciating asset. When I bought I always bought closer to wholesale than retail and when you are in that position you have the luxury of driving them for a year or longer and possibly making some money.

What happened in 2020 with Covid and the used car market, we seen used (newer 1999 and up water-cooled) 911’s climb in price solely because auto manufactuers shut down or cut back production hugely………..no or very limited new vehicles?…………used prices go up (supply and demand). I have been looking for a 997.2 for over 2 years and I will not pay $20,000 or more over their used prices in 2020. I am not talking about the so-called “collectable” versions of the 911 BUT……….the is NO collectability to a base 911 Carrera, 911 Carrera S, 911 Carrera 4 or 911 Carrera 4S………….ALL mass-produced as far as Porsche numbers go. I laugh when someone thinks their 996 POS that was bought for $15,000 and someone would pay $30,000 for it now and will continue to go up.

Wait it out for these cars, a correction is coming…………..nothing new taking a bath money-wise in depreciation on a new vehicle but to lose $15,000 to $20,000 on that dream, mass produced 911 used one you had to have will really hurt.

Hi David, Any 73 Camaro story’s.

Hahahaha!

71 Z/28……….LOTS!

Hogger John?

I just drive my 991.2 and smile. The “investment” wasn’t the reason I got it. It was for the enjoyment. People need to keep that in sight.

Don’t forget about all the billions in free money from the gov businesses got in PPP loans and owners had to spend it or lose it/pay interest on it. Why so many bought new boats, collector cars, etc under their business. The largest economy inflator in history and no one is talking about it.

These cars are all basically for the track, especially the 911’s and Corvettes, and one possible cause of the reduction in prices is that at least some small portion of them have actually been used for the purpose for which they were intended. The trailer queens with triple digit mileage that sell on BaT for astronomical sums may now be balanced out by a few GT2’s and ZR1’s that have some hard mileage under their tire belts.

With the Mustangs, there’s a new generation being rolled out and I’m guessing some buyers are holding off to see what follows and tops the Dark Horse.

I think there is a finite number of people willing to overpay (high new car market adjustments) for a number of these cars…it’s still quite a few people, but not endless. At some point those people will have what they wanted. I agree with the comment above that a market correction is (should be) coming for models that are not limited / special versions. Lots of wealth transferred just to be first…and I just hope this is not how our market closes out combustion engine cars.

lf you can wait…the product cycle will change . remember when everyone had a Harley in their yard…. now there are tons of ‘seldom-ridden-always -waxed-trailer queen’ bikes going quite quite reasonably… most have as much spent on options, alone, as the asking price even if they are a decade or more old..usually no mile at all. now, in my area, everyone sold their bike for the latest status symbol, a Kubota / jd/ tractor loader back hoe….. and in five years tons of those will be at firesale prices…. gonna hold onto my GR tho’