Reputation Management: Can tech companies “disrupt” the dealership model?

Welcome to Reputation Management! In this series, we’ll explain the oft-mystifying behavior of your local automotive industry—places like car dealers and service shops.

First, we’ll dig into publicly available customer reviews for those businesses. Then we’ll remove the names and discuss the situation from multiple viewpoints, leaning on my years of experience as a—you guessed it—reputation manager.

If we do this right, you should walk away a better, smarter consumer. Let us know what you think in the comments! —Sajeev

***

The acronyms B2C and B2B are engrained in every business student before graduation. Or at least they should be, as they have serious ramifications for any commercial undertaking. No matter, the terms themselves are deceivingly simple to define: business-to-consumer (B2C) means a company sells directly to its end users, while business-to-business (B2B) are transactions between individual businesses. When it comes to the business of selling new cars, the B2B model is generally hated by consumers, as there’s a greedy, scammy, scummy middleman that mucks up the transaction.

But now we’re looking at a tech company that, in the grand tradition of tech disruption, eschewed the B2B franchised car dealership model and chose an uphill legislative/financial battle instead. This outfit goes B2C for everything, including vehicle sales, parts, collision support (partially), and service. The last was brilliantly reimagined with OTA software updates and mobile servicing on a large scale; hats off to them for making that work. Success in B2C for a mass-produced product is no small feat, even for a retailing organization that sells luxury goods to a higher-end clientele.

While I always try to anonymize the businesses portrayed in this series, it is almost pointless in this case: We all know the cars, the company, and the man at center stage, though perhaps we haven’t considered how his values and norms likely trickle down to his company’s retailing division. He’s been a success in the car business, stealing market share from retailers with reputations for superior customer service (BMW, Lexus, Porsche, etc.) on a regular basis. So while I focus on bad reviews in Reputation Management, I’m not here to bury this automaker’s retail footprint. Instead, let’s remember that all forms of automotive retail are complex and challenging.

Remain open during business hours

Short of a hurricane, blizzard, etc., no traditional dealership management team would get away with this. (No such disasters happened when this review was written—I checked.) If there were a localized power outage, a note left on the door informing everyone about the facility’s issue woulda been nice: Most local businesses have paper, black Sharpie pens, and clear Scotch tape to make that happen.

Even worse, this location’s Business Development Center (BDC) was clearly unaware of the closure. Had anyone there known, they coulda called/emailed the customer to reschedule the appointment. Back when I was a reputation manager, I was on group emails that informed all the right people of emergency closures, we knew what we needed to do to support the store, and we dropped everything to get it done (because we liked our jobs, and liked not being yelled at by store management). I wonder if such retailing business norms are relevant to a company with disruptive technology?

Have more bathrooms?

I understand the entrepreneurial, tech-company mantra of running lean until you make it. But retailing comes with certain standards, especially when selling luxury goods. Since I used to frequent this location when it was a Borders Bookstore, I am somewhat confident it was originally configured with more than one bathroom for customers. Makes me wonder if the auto retailer turned the bookstore’s other bathroom into a lavatory exclusively for technicians. If I’m right, this proves that tech-company disruptions also apply to one’s digestive system!

Enough with the bathrooms already!

When customers wait long enough without adequate reassurance, they tend to focus on every little annoyance. It’s a slow burn, and leads to nitpicking out of boredom and spite. This is a big problem in retail, though the service center netted a 3-star review for meeting the customer’s expectations. Clearly, this is one of those good customers you work hard to keep happy and loyal.

The honeymoon is over?

This self-aware customer understands that the high from buying a new car eventually wears off. The irony is this brand is known for a smooth, relatively seamless purchase thanks to copious amounts of online intervention. Still, that online experience remains dependent on the buyer’s unique situation and on the retailer’s ability to extract concerns after delivery, when the transaction finally becomes face-to-face. To the company’s credit, the customer still admits this buying experience was better than that of a traditional dealership franchise.

For retail customers only?

We’ve heard the horror stories of buying these cars second-hand, mostly from that guy who made a name for himself highlighting these brand’s missteps at the retail level. While this review is not representative of your average consumer, someone who works in the car business can still be a customer. They need parts and service too, and every moment a vehicle can’t be on the market is a lost opportunity. This problem portrayed here is unique to these vehicles and it begs the question: Is all of the information requested by this customer available on a monroney sticker?

I’d wager yes, and resellers now need to insist on obtaining a window sticker from the previous owner before purchasing a vehicle. If the sticker is missing, that becomes a ding on the value of the vehicle, just like a missing second key. Because if this company’s rule is indeed to only divulge information to registered owners, the used-car market must adjust accordingly.

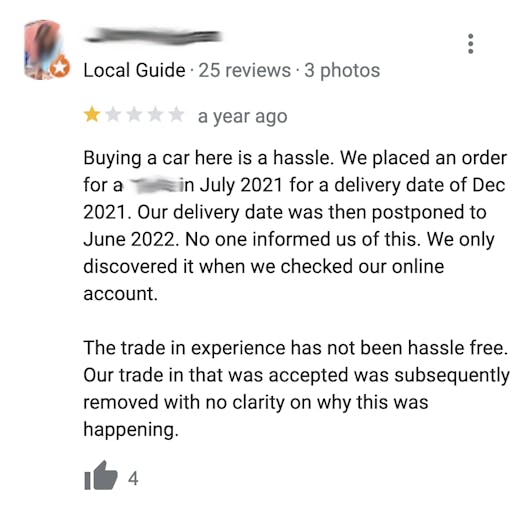

Poor communication?

I wonder how much of this review was aimed at the aforementioned Business Development Center, not the specific dealer location. No matter, this story proves that the final place for the transaction receives the brunt of the customer’s ill will. Chances are the customer has some issue with the title of the vehicle that they traded in, or perhaps the employee handling the trade-in found a misrepresentation in the vehicle’s condition. Instead of updating the customer, someone instead voided that part of the transaction?

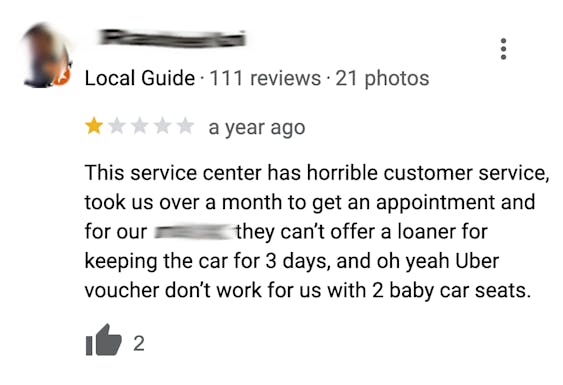

Expensive cars = more loaner cars

It used to be that every dealership had a minivan they could pluck out of inventory and place into service as a cut-rate shuttle for customers. Their porter could drive it on multiple occasions, especially in the mornings, when folks normally drop off their vehicles. Not so these days, as minivans are scarce, and, for dealers, Uber vouchers are cost-effective (so far). Especially for cheaper car brands, as those manufacturers can’t expect retailers to maintain a fleet of loaner cars.

But we aren’t discussing a cheaper car brand, as loaners are expected for vehicles at the price point of those sold by our tech company. Then again, perhaps this customer is servicing an older vehicle that is out of warranty. If so, loaners are not necessarily guaranteed. Time to trade up to a new one, as perks like free loaner cars are how they get ya hooked.

Parking lot problems?

As previously mentioned, this facility was initially a Borders Bookstore. Big-box retailers always have an unsecured parking lot that faces a major road. Thanks to minimum parking standards, these lots are shockingly oversized.

A traditional car dealership’s service lot can be similar in size, but it is at the back of the building, fenced-in to provide a modicum of security. This is why repurposing a big-box store for a premium automotive retailer is questionable—I always wondered if theft would be an issue.

Whether or not the theft was performed by an employee (not some hacker/rando with access to the employee’s KeyTrak machine) depends on how much you trust people to tell the truth. Vehicles from this brand are far from bank vaults, whether you’re trying to jailbreak or to hack by drone. No matter, service departments usually have signage telling customers something like “remove your valuables, we ain’t responsible for human nature” on their property.

Make note of the 7 “likes” given to this review: That’s a high number for any local businesses on Google. These responses prove the brand’s high level of desirability, as people are using reviews to research the vehicles. Sadly, it is human nature to like a negative post that reinforces your opinions.

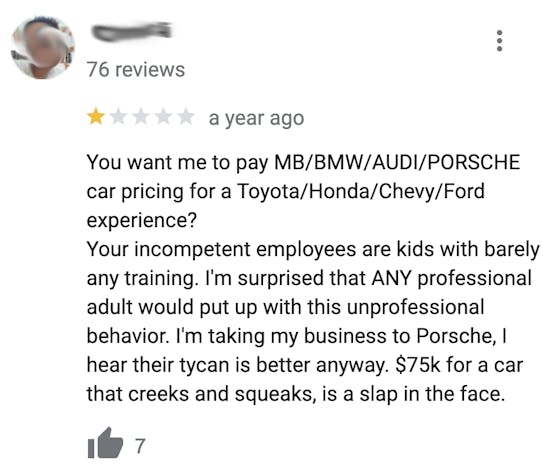

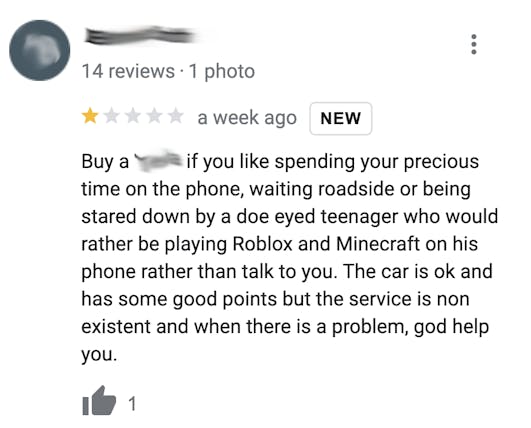

Expensive cars demand premium experiences

There has been talk in the past about a high turnover rate among the employees of this company, but the media usually reports on issues at the managerial level. The number of bad Google reviews mentioning employee training suggests that high turnover is a problem elsewhere in the organization. Surprisingly, this is one of the few reviews that mentions poor build quality, even though that’s supposedly a big problem with this brand. Perhaps most folks know that the service center isn’t at fault for flawed workmanship at the factory.

But is that distinction without a difference when the same company owns both factory and service center?

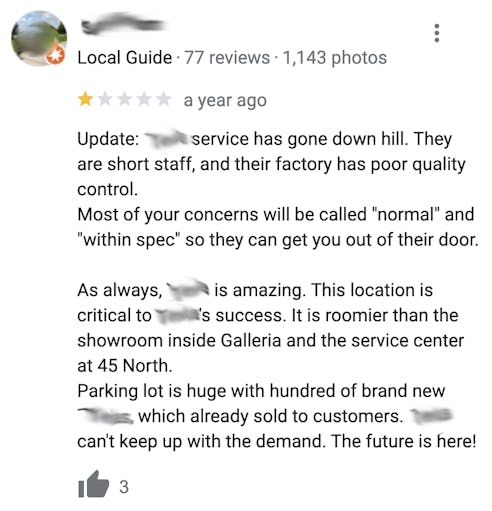

Where’s the motivation to fix stuff?

Based on anecdotal evidence like that presented here, I have forged a theory: Because there is no ownership distinction between factory flaws and repairs by retailers, it is in the company’s best interest to suggest that issues are “normal” or “within spec.” Franchised dealerships have a financial motivation to do more diagnostic work, as doing so generates parts sales and warranty-claim money from the manufacturer. It, by design, wants to reduce such payouts.

Multiple fail points?

I generally discount a customer’s review if they take potshots at employees, and I doubt I’m the only reputation manager who feels that way. Still, this person likely left this vague review because of specific problems that couldn’t be addressed by retail staff members. I bet everyone involved was having a bad day when this happened, but such issues could be resolved with more knowledge/training and a higher number of seasoned professionals in the store.

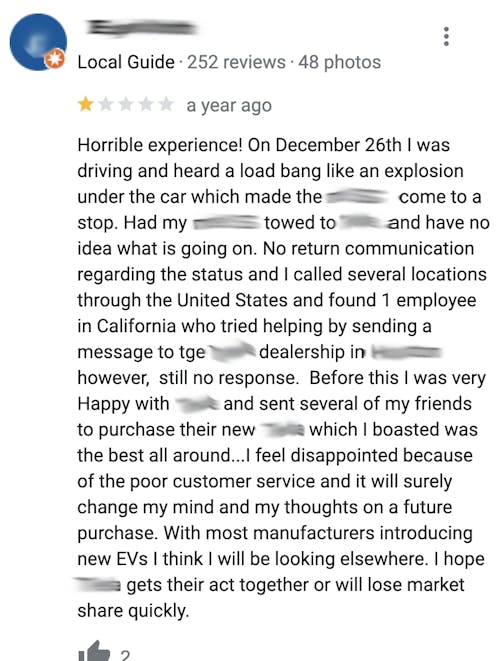

The customer, the soothsayer

This customer might as well be a top-dollar management consultant, as they expertly turn the problems they experienced into a generalized statement about the brand’s long-term prospects. Well-written negative reviews are always the most painful to read, at least to this former reputation manager.

What does the future hold?

I question if a full-line, volume automaker can do B2C retail better than the B2B dealership franchise model. (A full-line manufacturer sells vehicles of many different kinds to address different slices of the market: Compact SUV, sedan, full-size SUV, sports car, truck, etc. Think Toyota, or GM.) That’s because the tech company we’re discussing has yet to become a full-line automaker, yet they clearly have issues with employee training/retention, multi-faceted customer experience concerns, and even facility design flaws.

Clearly this strategy still works, as the company still has a soaring stock price, legions of loyalists, and aggregate Google reviews in the four-star territory for many (most?) locations. Perhaps usurping the franchise model was the correct way to build their brand. Or are they cutting off their nose to spite their face? Probably a bit of both. One thing is certain: Their competitors aren’t nearly as fortunate.

One such competitor literally threw in the towel, opening themselves up to the franchise model. Their CEO told Reuters that “opening our own stores is great but it takes a lot of time,” and “joining forces with other partners to go faster has always been our nature.”

The problems seemly get worse when these “disruptive” tech companies scale up and mature. Remember when The Facebook was designed for college students? Back in the mid-to-late 2000s, the user experience was collegiate—you got to hang out with a group of like-minded dorks. Eventually, the platform became an international scandal, posting billions of dollars in losses in the second quarter of 2023. Customer service is difficult to maintain in these situations, especially when appropriate staffing levels for front-line workers are out of the question.

Since we all loathe traditional car dealerships, consider examples of the franchise model we appreciate. Most fast-food joints know it’s both labor intensive and terribly expensive to scale up without franchisees doing the heavy lifting. In many ways, McDonalds, Wendys, and Whataburger set the gold standard in retailing a mass-market product/service to the public. But this tech company isn’t flippin’ patties: It must sell, finance, and service an automobile.

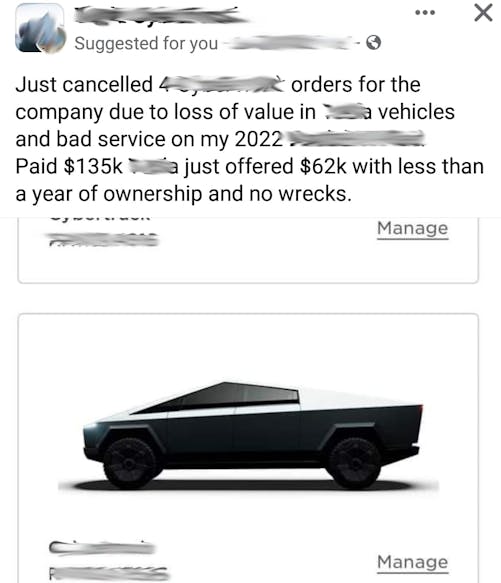

And those automobiles are more than just transportation: They promise to change the world. That positioning suggests that the company isn’t content with surviving on low-volume, low-margin vehicles. To be fair, the latter has changed in the last three years, but the pendulum is now swinging in the wrong direction.

Their recent history of price drops for cars aimed at their original, well-endowed core audience is concerning, to a greater extent than the drops for the cheaper models. That’s because this company’s level of damage control feels inadequate: Price drops ensure recent customers are now making payments on a vehicle wallowing in thousands of dollars of unexpected depreciation, and the market for used examples will drop accordingly. At least Saturn gave retroactive rebates to customers who bought new vehicles up to 6 months before the price drop. Great idea, and that model worked well for those who hate the traditional dealership haggling model … until it didn’t.

The problems presented in the B2C world are harder to find in the traditional dealership business model, as the middlemen eat the manufacturer’s production miscalculations and use their own capital to remain competitive in their market for sales (and service). I wager that social distancing isn’t just for people in a pandemic, it’s for manufacturers, retailers, and customers of new vehicles. Don’t get me wrong: the old way of selling new cars has many, many flaws, but the customer-service issues, recent price drops, and inventory spikes with this disruptive manufacturer will likely damage its brand equity for years to come.

***

What did you think of Reputation Management? Was this a good use of your valuable time? Would you like to see more—and if so, anything you’d change or add?

We’re always open to suggestions from the Hagerty Community, and if there’s a type of business you want to discuss, odds are we can find it online. Tell us what you think in the comments!

I enjoy this series. I will be a simpleton for a moment:

-buy from the live person teller whenever you can: it’s a vote for their job (even if they are paid to direct you to self check out).

-online purchases are handy, and every one we click is a chip away at the viability of local/domestic business. Granted that one giant online retailer is pretty good at returns and issues management…

-If you can afford to buy new, the more local you buy the more direct the influence in your own community, even if the vehicle is made far away.

-If there is only 1 auto manufacturer in your county, state, region of country or nation… buying from that one is the most direct impact locally.

-buying a poorly made, tepid designed, assembled overseas with questionable environmental/labor oversights vehicle to signify forward-thinking virtues is something many people will look back upon with “oops”.

-stock valuation is a funny thing. I read an article that dug deeper into Uber a few years ago (so out of date). At that time the fare model was not profitable. The stock rise was on market-reach growth. Step back, and the goal was put traditional taxis out of service then raise the prices. Not sure how true that has all proven…

…but I do know that traditional taxi companies where I live have oppressive oversight and restrictions on them and early years driveshare services had none of that. Not exactly a competitive marketplace. Eventually consumers lose.

The more shadowy, elusive, not actually present in your community a business operation is the less loyalty (or need) to be a genuine player in the community is.

Anyways, tech disrupt on. Surely it will all be a rosier future.