Despite strong results, Amelia 2022 auctions proved bidders have limits

Maybe we’ve gotten spoiled.

The 2022 Amelia Island auctions concluded with $127.7 million in sales, well ahead of 2021’s total of $78.8 million but behind our forecast of $149.6M. The sell-through rate ticked up from 90 percent in 2021 to 92 percent this year, but the consistent steps up in value we have seen since late 2020 appears to have paused for now.

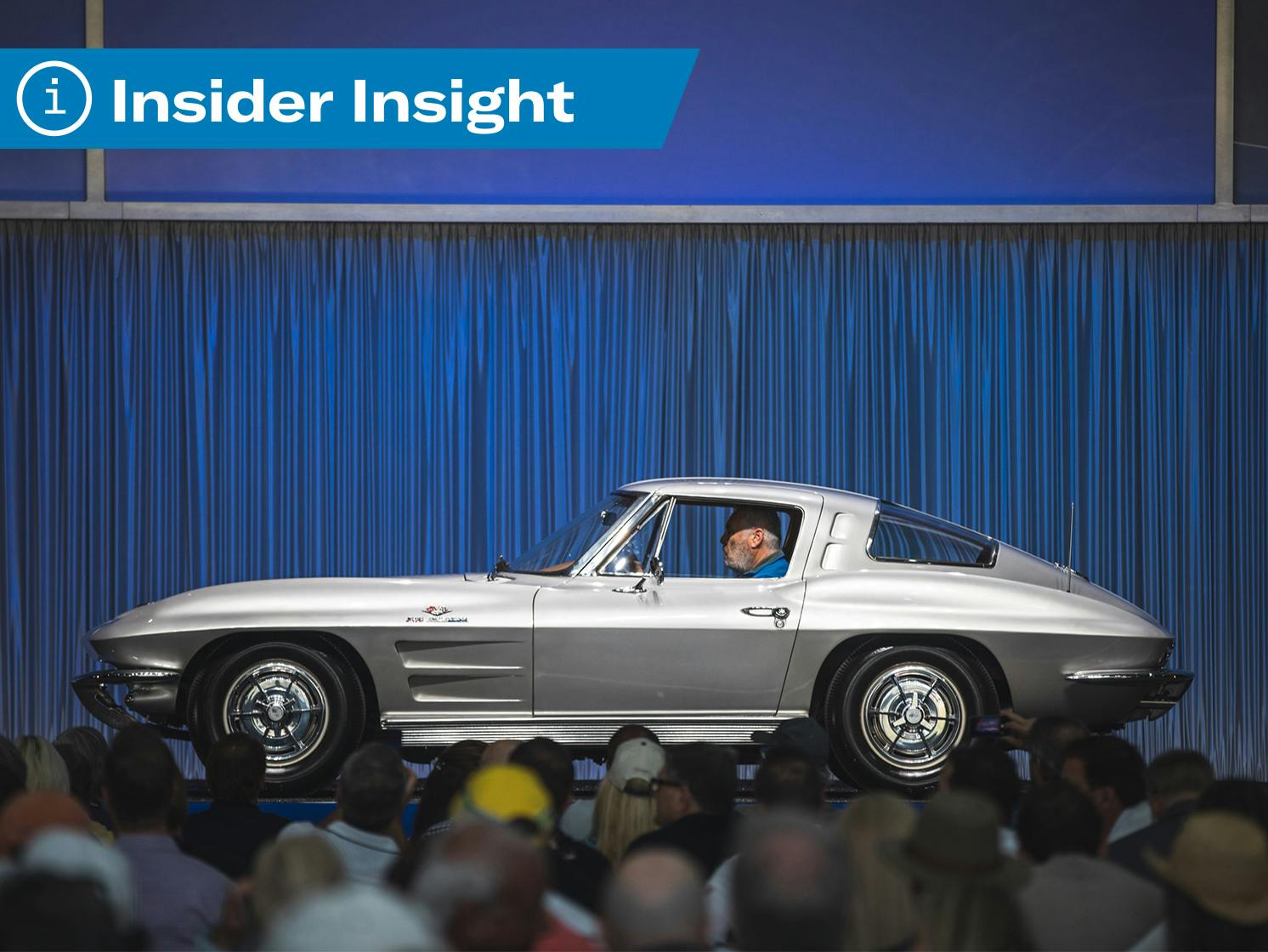

Friday was the big night with the biggest buzz with over $66 million in sales for Gooding and 80 percent of cars with Hagerty Price Guide values selling for more than 10 percent over their condition values. Their 1937 Talbot-Lago T150-C-SS Teardrop Coupe by Figoni et Falaschi sold for $13,425,000, which was a record for a French car. Their sale of the 1967 Toyota 2000GT race-prepped by Shelby sold for $2,535,000, which is a record for a Japanese car.

Overall, the week confirmed that the market is still very hot and included many record sales, but Amelia was not another leap upwards as we saw at the January 2022 auctions. It’s tempting to blame events in Europe, which managed to roil the stock market even as bidders were descending upon Amelia. Yet if we’ve learned anything from the last two years, it’s that collectors will continue collecting despite—and maybe even to escape from—turmoil in the world at large.

Rather, we suspect we’re simply seeing a market-finding equilibrium: The strong prices over the last few years have drawn more sellers—this year’s Amelia auctions had the most consignments since before the pandemic and the highest ever percentage of cars with estimates over a million. Bidders were willing to play ball but sellers, perhaps spoiled by a year of estimate-beating sales, were often holding out for more: a quarter of cars that did not sell were bid to Hagerty’s #1 (concours condition) value. Sellers, or even the auction companies, are overestimating the heat of the market.

We could see the impact of broader economic trends in the particular vehicles that did better than others. Staple collector cars—Ferraris and Porsches in particular—tend to be a hedge against inflation and, generally, a safe place to park money when other markets are unpredictable. They did well here. In contrast, bidders seemed to have a smaller appetite for rare oddball cars that are harder to gauge current or future value.

Porsche in particular made a strong showing at Amelia Island—not surprising since the event caters to the German marque. $33 million of Porsches were sold at a perfect sell-through rate over the three auctions, more than three times the marque’s total sales in 2020 on only 30 percent more lots. The average sale price more than doubled as ten Porsches sold for over $1 million—and that count doesn’t the $2-million 1998 RUF Turbo R Limited, which set a record for the venerable builder of hotrod Porsches.

Some big sales of prewar classics prove the market isn’t just buying their youth and moving on as demographics shift. Three of the top five sales were from the 1930s, with the Talbot-Lago taking the top spot, a 1934 Packard Twelve-Series 1108 Dietrich Convertible Victoria sold by RM Sotheby’s for $4,130,000 in third, and a 1930 Duesenberg Model J Murphy Convertible Sedan also sold by RM Sotheby’s, but for $3,525,000 in fifth place. This is the second year in a row that prewar cars have performed particularly well at Amelia, suggesting that even as more collectors gravitate toward online auctions, curated in-person sales seem to be the “right” place for these older machines, which tend to benefit more than other cars from in-person inspection.

That said, it’s worth noting that many of the prewar cars that sold here, even those that brought big prices, tended to be flat compared to previous sales five or ten years ago. For instance, the 1913 Stutz Series B Bearcat that RM sold for $250,000 was bought in 2015 for $577,500, and the 1932 Buick Series 50 Sport Phaeton that was sold for $78,400 was bought for $134,550 in 2010. At a time when all vehicles old and new seem to cost more for the same exact thing, a prewar car might look more enticing by providing that same ownership experience for less.

Analog supercars such as the 2005–2006 Ford GT, Porsche Carrera GT, Jaguar XJ220 and Ferrari F40 continue to perform well. The Jaguar XJ220 set a record at $687,000. A 2005 Porsche Carrera GT also set a record at $2,012,500, although given their performance as of late, we don’t expect it to stand for long. The two Ford GTs sold for more than the condition 1 value, and the Ferrari F40 was just below the condition 1 value at $2,452,500. We expect analog supercars will continue to power through any current market uncertainty as their ready appeal and unique place in the market helps.

Overall, the bidding at Amelia was certainly enthusiastic but not overly so. In the long run, that may be a good thing. An overheated market is one that has the potential to cool suddenly. What we saw in Amelia was car collectors were still very much willing to pay big money for exceptional cars, but not willing to spend recklessly. That bodes well for the long-term stability of collector car values.

While the next major auction event of this caliber won’t be until August, Mecum’s Glendale auction in Arizona happens later this month and of course, online auctions will be a worthwhile distraction in the meantime.