Prewar cars aren’t dead, and other lessons from the 2018 Monterey auctions

By all accounts this year’s Monterey auctions were a success. Over the course of three days, 844 cars sold for a grand total of $370 million. The gross take was 13 percent above last year and beat Hagerty’s forecasted amount by 8 percent. Looking beyond the high-level numbers, here are four takeaways from all the action.

1. Elite cars are still in strong demand

20180717171241)

The most obvious lesson coming out of Monterey this year was that crown jewel-type cars are still hotly contested. The era doesn’t matter. Few eight-figure cars came to market during the first seven months of the year and it wasn’t clear if changes to American tax laws, wariness among buyers of the market’s short-term trajectory, or some other motivation was the cause.

In the end those questions became moot. The three-star cars of the week (RM Sotheby’s 1962 Ferrari 250 GTO that sold for $48.405M and 1963 Aston Martin DP215 that sold for $21.455M, and Gooding and Company’s 1935 Duesenberg SSJ that sold for $22M) all traded at or above expectations. Clearly there are still more people chasing after the rarest and most storied models in the car world, and for those types of cars it is still a seller’s market.

2. It ain’t all roses

20180625204949)

Selling three cars for $91.5M can hide a lot of misses. The $1M–$10M range underperformed this year, and Ferrari in particular (the 250 GTO aside) did not fare well. The sell-through rate for the Maranello marque was a shocking 53 percent, down from 68 percent in 2017, which is virtually unprecedented. Porsches corrected in 2016 and ’17, Ferrari may be doing the same now, which could be cause for alarm. Historically Ferraris have been a leading indicator for the market.

3. Originality and odometers above all else

Most of the biggest surprises of the week were for cars that were fresh to market, had driven relatively few miles, and were largely original. (And “low miles” didn’t necessarily mean no miles—it meant a smaller odometer reading relative to what other cars of the same year and model carry).

A stunning $112,000 sale price for a 28,000-mile 1948 MG TC (28,000 miles and three owners from new), a $368,000 1958 Porsche 356A 1600 Super Speedster at RM Sotheby’s (offered for the first time in more than 50 years), and a 2002 BMW M5 that sold for $176,000 (fewer than 500 miles travelled) are just three examples that tell the tale. Car collectors continue to become more discerning, paying eye-watering amounts for very specific examples and refusing to even offer a bid for similar but lesser models.

4. The prewar market is not dead

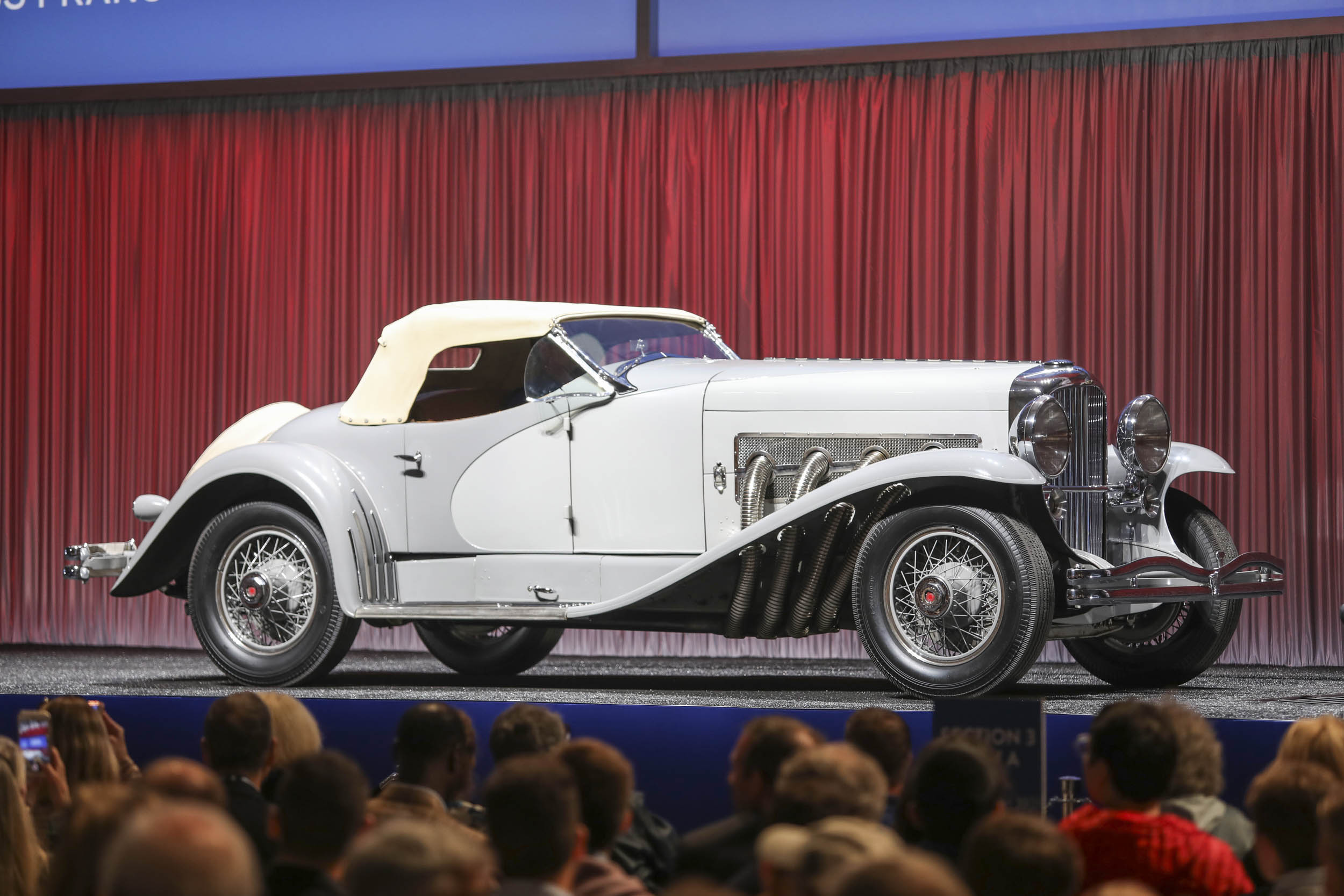

While the 250 GTO will understandably garner most of the headlines, Gooding’s Duesie SSJ is arguably the bigger story. This car is the prewar American car to have, but it was an absolute home run on the block. The car had the fiercest bidding of the week and soared well past its conservative low estimate of $10M to set a new record for a prewar car at auction.

Beyond that single lot, this year saw 15 prewar cars land among the top 25 American cars sold in Monterey, up from only eight the previous year. Other star sales include a 1933 Duesenberg Model J Convertible Coupe from Mecum ($3.85M), a 1931 Bugatti Type 51 Grand Prix car that sold for $3.74M (Gooding), and a $539,000 1937 Cord 812 Sportsman Cabriolet (Gooding). While younger buyers are much more interested in modern performance, there are still plenty of active buyers chasing after quality prewar cars.

20180727152841)